An Equilibrium Model of Rollover Lotteries (with Giovanni Compiani and Lorenzo Magnolfi)

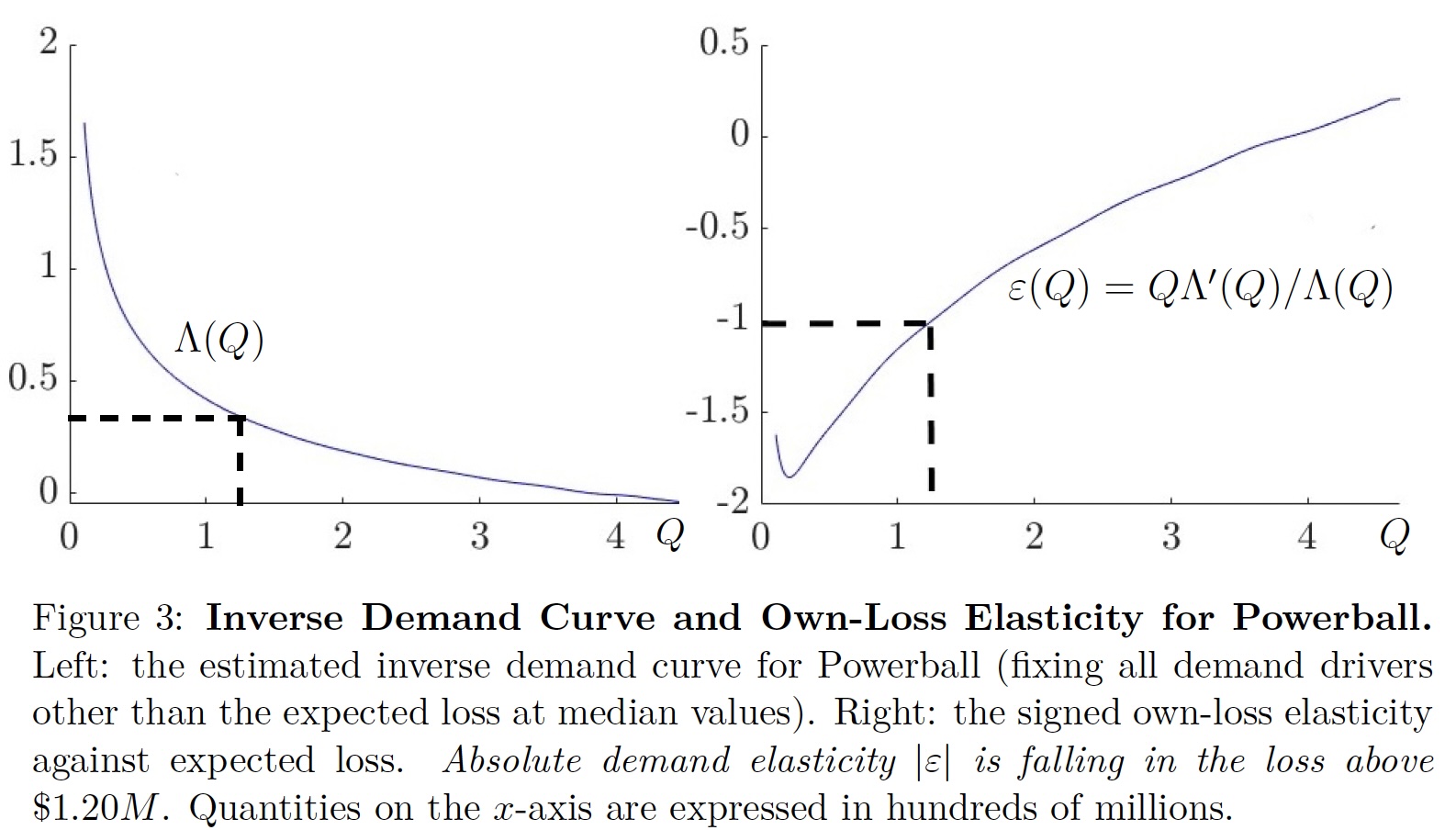

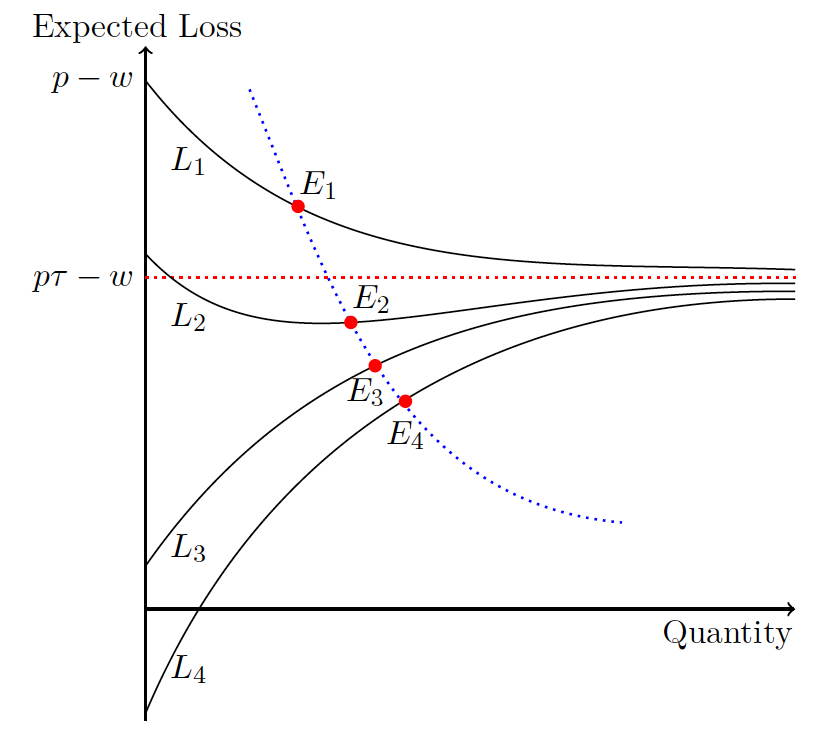

Abstract: This paper develops estimates, and illustrates a market model of rollover lottery ticket sales, premised on the assumption that people buy tickets for two reasons: They prefer money won and they enjoy an idiosyncratic thrill over the lottery experience. If everyone were risk neutral, then you could say that people buy whose thrill exceeds the expected loss on the ticket – namely, the prices minus the expected winnings. For every number of tickets sold, lottery rules imply an inverse supply curve of expected losses – where they treat the monetary loss on tickets as an implicit price. We non-parametrically estimate the demand for Powerball.

Our model allows risk aversion or risk-loving utility, but slight deviations from risk neutrality are inconsistent with the data. This is a very high stakes empirical test of Rabin’s (2000) calibration thought experiments that low stakes risk aversion yields implausible larger stakes implications. While ticket buyers are risk neutral, Powerball acts a risk loving gambler for rollovers up to $600M. But we prove that Powerball should cap the jackpot at $910 million.

Aside from the model fit, we check risk neutrality in two ways. First, we characterize how log ticket sales should convexly grow in the log jackpot at least up to $408M — which we verify in Powerball data. Next, lottery odds should scale linearly in the population — which we verify in a regression across forty state rollover lotteries.